Best crm software for private equity – Private equity (PE) firms require robust Customer Relationship Management (CRM) systems to effectively manage complex relationships, track deal flow, and maintain meticulous records. The right CRM can streamline operations, improve investment decision-making, and ultimately boost returns. This comprehensive guide explores the best CRM software options tailored to the unique needs of private equity professionals, examining features, benefits, and considerations to help you choose the perfect solution for your firm.

Understanding the Unique Needs of Private Equity CRMs

Private equity differs significantly from other industries. A PE CRM must go beyond basic contact management. It needs to handle:

Source: ascendix.com

- Complex Deal Tracking: Managing multiple deals simultaneously, each with numerous stakeholders and intricate details, requires a system with robust deal pipeline management capabilities. This includes tracking deal stages, deadlines, key documents, and communication history.

- Investor Relationship Management (IRM): Maintaining strong relationships with Limited Partners (LPs) is crucial. A PE CRM should facilitate communication, reporting, and performance updates to LPs, fostering transparency and trust.

- Portfolio Company Management: Once investments are made, ongoing monitoring and management of portfolio companies are essential. The CRM should allow tracking of key performance indicators (KPIs), financial data, and communication with portfolio company management teams.

- Extensive Reporting and Analytics: Private equity relies heavily on data-driven decision-making. The CRM should provide customizable reporting and analytics dashboards to visualize deal flow, performance metrics, and investor relationships.

- Security and Compliance: PE firms handle sensitive financial and confidential information. The CRM must adhere to strict security protocols and regulatory compliance requirements, such as GDPR and CCPA.

Top CRM Software for Private Equity Firms

Several CRM platforms stand out as particularly well-suited for private equity. The best choice depends on specific needs and budget. Here are some leading options:

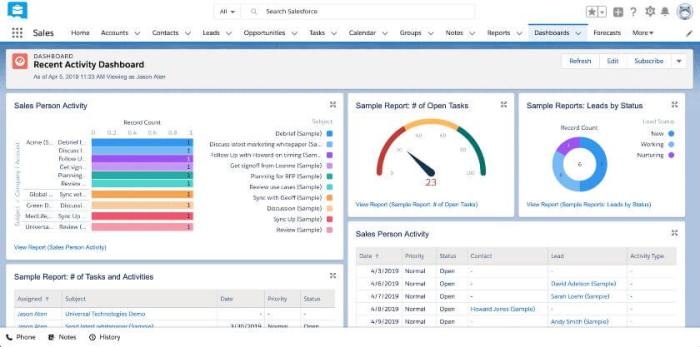

1. Salesforce

Salesforce is a highly customizable and scalable CRM platform with a vast ecosystem of apps and integrations. Its features include robust contact management, deal tracking, reporting, and analytics. Salesforce’s strength lies in its flexibility, allowing customization to match specific PE workflows. However, it can be complex to implement and requires specialized expertise.

Source: founderjar.com

2. Microsoft Dynamics 365

Microsoft Dynamics 365 offers a comprehensive suite of business applications, including a powerful CRM solution. Its integration with other Microsoft products like Excel and Outlook is seamless, making it a popular choice for firms already invested in the Microsoft ecosystem. Dynamics 365 provides strong reporting and analytics capabilities, but its customization might be less extensive than Salesforce.

3. HubSpot, Best crm software for private equity

HubSpot is a popular choice for companies focusing on inbound marketing and sales. While not solely designed for PE, its features such as contact management, deal tracking, and reporting are applicable. HubSpot’s user-friendly interface and relatively affordable pricing make it attractive for smaller PE firms. However, its scalability might be a limitation for larger firms with complex needs.

4. Dealroom

Dealroom is a specialized CRM specifically designed for private equity and venture capital firms. It focuses on deal sourcing, tracking, and management, providing features such as company intelligence, competitive analysis, and investor relationship management. Its strength lies in its targeted functionality for the PE industry, but it might lack the broader capabilities of general-purpose CRMs.

5. Pipedrive

Pipedrive is a sales CRM with a user-friendly interface and intuitive deal pipeline management. While not specifically built for PE, its simplicity and ease of use can be advantageous for smaller firms. Its affordability and straightforward approach make it a good option for those prioritizing ease of use over extensive customization.

Choosing the Right CRM: Key Considerations: Best Crm Software For Private Equity

Selecting the right CRM involves careful evaluation of several factors:

- Firm Size and Complexity: Larger firms with complex deal flows and numerous investors require a more robust and scalable CRM than smaller firms.

- Budget: CRM solutions range widely in price, from affordable cloud-based options to expensive enterprise-level platforms. Consider the total cost of ownership, including implementation, training, and ongoing maintenance.

- Integration Capabilities: The CRM should integrate seamlessly with other software used by the firm, such as portfolio management systems, financial reporting tools, and communication platforms.

- Customization Options: The ability to customize the CRM to match specific workflows and reporting requirements is essential for maximizing its effectiveness.

- User-Friendliness: The CRM should be intuitive and easy to use for all team members, regardless of their technical expertise.

- Security and Compliance: Prioritize a CRM that meets industry security standards and complies with relevant regulations.

Frequently Asked Questions (FAQs)

- Q: What is the average cost of a private equity CRM? A: Costs vary significantly depending on the chosen platform, features, and number of users. Expect to pay anywhere from a few hundred dollars per month for basic cloud-based solutions to thousands of dollars per month for enterprise-level platforms.

- Q: How long does it take to implement a new CRM? A: Implementation time depends on the complexity of the CRM and the firm’s specific requirements. It can range from a few weeks to several months.

- Q: What are the key metrics to track in a PE CRM? A: Key metrics include deal flow, deal size, investment returns, fundraising activity, LP communication frequency, and portfolio company performance KPIs.

- Q: Can a CRM improve fundraising efforts? A: Yes, by effectively managing relationships with LPs and providing transparent performance reporting, a CRM can significantly improve fundraising efforts.

- Q: What are the risks of not using a CRM in private equity? A: Not using a CRM can lead to inefficiencies, missed opportunities, poor communication, regulatory compliance issues, and ultimately, reduced investment returns.

Resources

Call to Action

Investing in the right CRM is a critical step towards optimizing your private equity firm’s operations and maximizing returns. Contact us today to discuss your specific needs and explore how we can help you select and implement the ideal CRM solution for your business.

Detailed FAQs

What are the key features to look for in a private equity CRM?

Key features include robust deal tracking, portfolio management tools, contact management, detailed reporting and analytics, secure data storage, and seamless integration with other financial software.

How much does private equity CRM software typically cost?

Pricing varies significantly depending on the features, scalability, and vendor. Expect to pay anywhere from a few hundred dollars per month to several thousand, depending on your needs and the number of users.

Can a CRM help with regulatory compliance?

Yes, some CRMs offer features that aid in regulatory compliance by providing audit trails, data security measures, and tools for managing sensitive information.

What is the best way to integrate my CRM with existing systems?

The best integration method depends on your existing systems. Options include API integrations, data imports/exports, and third-party integration tools. Consult with your CRM vendor for guidance.