Best accounting software for real estate investors – Real estate investing can be a complex undertaking, requiring meticulous record-keeping and financial management. Choosing the right accounting software is crucial for maximizing returns, minimizing tax liabilities, and ensuring overall financial health. This guide explores the best accounting software options tailored specifically for real estate investors, providing a detailed comparison and helping you make an informed decision.

Understanding Your Needs as a Real Estate Investor: Best Accounting Software For Real Estate Investors

Before diving into software comparisons, it’s essential to understand your specific needs. Are you a small-time investor managing a few properties, or a seasoned investor with a portfolio spanning numerous properties and entities? Do you need robust reporting features, advanced budgeting tools, or seamless integration with other real estate investment platforms? Consider these factors when evaluating potential software solutions:

Source: narolainfotech.com

- Property Management: Can the software handle multiple properties, tenants, and lease agreements?

- Expense Tracking: Does it provide detailed expense categorization and reporting for various property types?

- Income Tracking: Is it capable of tracking rental income, capital gains, and other investment income streams?

- Tax Management: Does it offer features for calculating depreciation, property taxes, and other tax-related calculations?

- Financial Reporting: Does it generate clear and insightful financial reports for your investment portfolio?

- Budgeting & Forecasting: Can you use the software to create and monitor budgets, forecast future income, and assess potential risks?

- Integration Capabilities: Is it compatible with other tools you use, such as property management software, mortgage platforms, or accounting tools?

- Ease of Use: Is the software user-friendly, intuitive, and easy to navigate?

- Cost: Is the software’s pricing structure reasonable and aligned with your investment volume?

Top Accounting Software for Real Estate Investors

Several robust accounting software options cater to the needs of real estate investors. We’ll examine some of the leading contenders, highlighting their key features and benefits.

1. Xero

Xero is a popular cloud-based accounting software known for its user-friendly interface and comprehensive features. It’s particularly suitable for small to medium-sized real estate portfolios. Xero’s strength lies in its ability to streamline expense tracking, generate financial reports, and integrate with other business tools. This ease of use and integration are valuable for real estate investors.

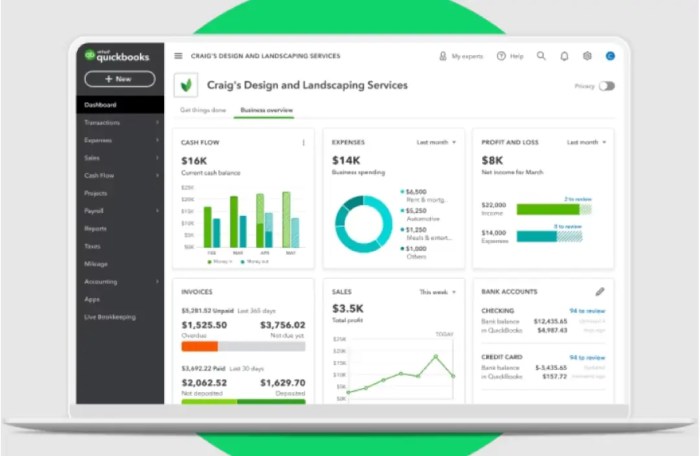

2. QuickBooks

QuickBooks, another widely used accounting software, offers a range of plans to suit different needs. Its robust features make it suitable for both small and large-scale real estate investments. QuickBooks’ strength lies in its extensive reporting capabilities and integration options. It also provides good tax management features, essential for real estate investors.

3. FreshBooks, Best accounting software for real estate investors

FreshBooks is another popular choice, particularly for freelancers and small businesses. It’s suitable for real estate investors managing a smaller number of properties. FreshBooks excels in its invoicing and expense tracking features, which can be crucial for managing rental income and expenses.

Source: crushingrei.com

Key Features to Look For

When selecting accounting software, prioritize these features to maximize efficiency and ensure accuracy in your real estate investments:

- Automated Invoice and Payment Processing

- Detailed Financial Reporting

- Expense Tracking and Categorization

- Tax Management Tools

- Integration with Property Management Software

- Multi-Currency Support (if applicable)

Real Estate Investment Accounting Best Practices

Regardless of the software you choose, maintaining accurate and organized financial records is critical. Implement these practices to optimize your investment process:

- Regular Bank Reconciliation

- Detailed Record Keeping of All Transactions

- Proper Categorization of Expenses

- Proactive Tax Planning

Frequently Asked Questions (FAQ)

- Q: What is the best accounting software for real estate investors?

A: The “best” software depends on individual needs and investment scale. Xero, QuickBooks, and FreshBooks are popular choices, each with strengths in different areas.

- Q: How much does accounting software cost for real estate investors?

A: Pricing varies significantly based on the software, features, and the number of users. Contact the software providers directly for pricing information.

- Q: Can accounting software help with tax management?

A: Yes, many accounting software packages include tax management tools to assist with calculating depreciation, property taxes, and other tax obligations.

Conclusion and Call to Action

Choosing the right accounting software is a crucial step in managing your real estate investments effectively. Carefully evaluate your specific needs, compare available options, and select a solution that best aligns with your investment strategy and budget. By doing so, you can ensure accurate financial records, streamline your operations, and maximize your returns. Contact us today to discuss your specific needs and receive personalized recommendations.

Contact Us Now!

Essential Questionnaire

What are some common accounting software options for real estate investors?

Popular options include QuickBooks, Xero, and specialized real estate investment platforms. Each has strengths and weaknesses, so careful comparison is key.

How important is cloud-based accounting software for real estate investors?

Cloud-based solutions offer accessibility and collaboration, which are vital for investors working with multiple partners or locations. They also typically offer robust reporting and data analysis capabilities.

What are some essential features to look for in real estate investment accounting software?

Features such as property management, expense tracking, and detailed reporting are crucial. Consider if the software integrates with other tools you already use, like mortgage calculators or CRM systems.

How can I budget effectively with real estate investment accounting software?

The software should allow you to categorize and track income and expenses. Use this data to create realistic budgets, monitor performance, and make informed decisions about future investments.